The key question to focus on is this – How can we best add value to our clients? In times of uncertainty, the person who brings the most clarity adds the most value.

Common questions that keep coming up:

- What’s going to happen to the economy?

- Will there be a lot of foreclosures?

- Is this going to be worse than 2008?

- What is going to happen to home prices?

- What is the best thing for us to do right now?

One thing to address upfront is we want to dispel the myth that we’re just sales people. We want to help consumers understand that we’re here to offer information to them. We can change our industry and get people to understand we’re here to help them.

“You don’t make the timeline, the virus determines the timeline.” – Dr. Anthony Fauci

The same thing applies to economic and housing market recovery. Markets can’t start functioning normally until the virus threat has diminished.

Question #1: What Will Happen to the Economy?

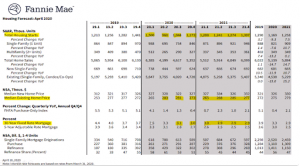

This chart helps a lot to understand what to expect in the economy and housing market. Nobody knows exactly what will happen, but this gives a high level view of what’s expected to happen over the next few quarters.

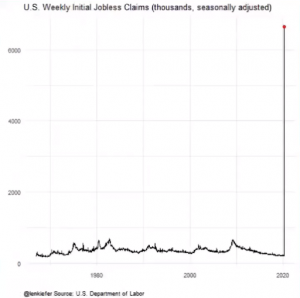

The next set of data helps to explain the virus’s effect on the economy and is based the number of jobless claims.

A total of 30 million people have filed for claims since mid-March, totaling nearly 19% of the workforce. That’s a huge number, much more than in previous recessions. We don’t expect this to be as long as previous recessions, but it will be “deeper” from an economic perspective based on the amount of unemployment claims.

The good news about stocks is they’re bouncing back. In April, we saw the best month since 1987.

Our view is that a personally defined strategy is the best way to navigate volatility. Everyone’s situation is different. As the economy starts to recover, consistent guidance is advised.

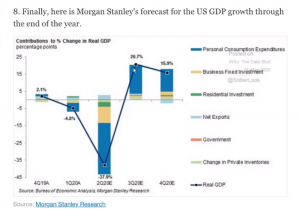

Something else to keep in mind is something stated by Morgan Stanley: By the time we announce we are in recession, following Q2, we might already be out of it.

They expect us to see a big jump in GDP. The tough thing about a recession is you need to have 2 Quarters of GDP decline and by the time that’s announced, we may be out of the recession.

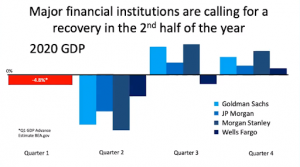

Keep in mind that major financial institutions are calling for a recovery in the 2nd half of the year.

Goldman Sachs, JP Morgan, Morgan Stanley, and Wells Fargo all expect that by Quarter 4.

Keep in mind if they’re wrong, they will lose a LOT of money. Their projections need to be accurate. If they aren’t, they lose a lot of money and so will their clients.

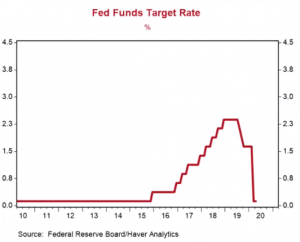

“Don’t fight the Fed”

If the Federal Reserve wants something to happen, they can make it happen! If they keep rates low, it keeps the cost of funds low and mortgage rates low.

For a while they had started raising rates, but now the rates have dropped again. We may keep these rates through 2023 or 2024, so we will have access to those lower rates for a while. They want to make the economy’s recovery as robust as possible.

We don’t know long-term effects, there may be higher tax rates in the future because of this. But the good news is the Fed will keep us in the game.

Will there be a lot of foreclosures?

Not necessarily.

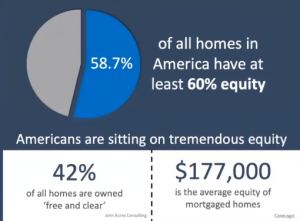

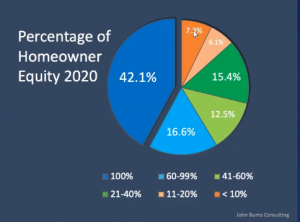

58.7% of homes have at least 60% equity. 42% of all homes are owned free and clear. $177K is the average equity of mortgaged homes. Less than 10% of American homeowners have less than 7.3% equity in the house. These are all good signs, because it shows people have the equity to weather this storm.

Some people are asking us if they should go into forbearance, but a lot of people are going into forbearance unnecessarily. It’s great for someone who just doesn’t have the money to pay their mortgage payment right now. However, don’t do it if you can avoid it at all, because it’s hard to get out of. It’s added as a repayment plan.

Instead, reach out to your mortgage professional or real estate professional for guidance. People who go into forbearance won’t be able to take advantage of the low upcoming interest rates. Something to keep in mind is that just mentioning the word “forbearance” on the phone with your lender may put you into it without signing anything! They may not even have you sign anything so be very cautious.

Is this Going to be Like 2008?

No.

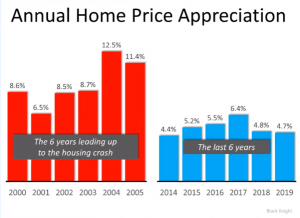

The annual home price appreciation before the in 2008 crash was huge. After the crash, the appreciation has been more normal, between 4-7%. From a real estate perspective, we’re solid right now.

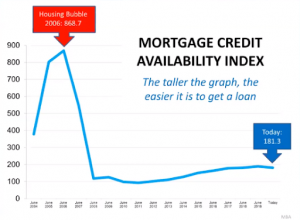

Something else to look at is the mortgage credit availability index. It’s much harder to get a loan, even today, than it was back before the great recession.

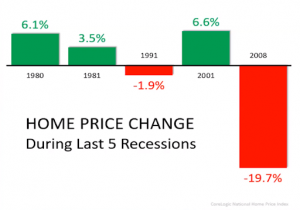

Another thing to consider is there’s only been one recession in the last 40 years where home prices went up. The -1.9% is too low of a factor to really consider. In other recessions, home values actually went up.

What is Going to Happen to Home Prices?

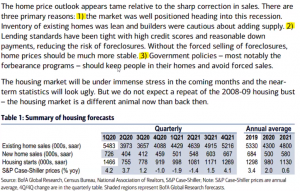

Here’s a great summary that explains three reasons why the housing market will be fine:

Here’s another chart that shows historical home prices, as well as the current forecast based on the virus. You see there is a sharp dip, but also a very quick recovery. That’s because there will be a lot of entry-level demand in homes.

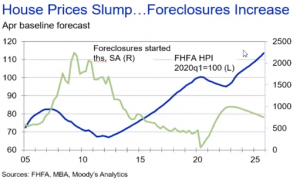

This next chart shows something similar. While the HPA was expected to be steady, it’s now expected to have a dip, then quickly recover.

People are going to be outbidding each other for homes before long, because prices are going to be down. Rates will also be low. Right now, the next 6-12 months, is a great time to get into a new home before the uptick comes and more people are flooding the market.

Below is one of many charts that also shows what tends to happen in a recession around foreclosures. You see there is a small dip between 20-23, but then will keep going back up.

Mortgage Rates

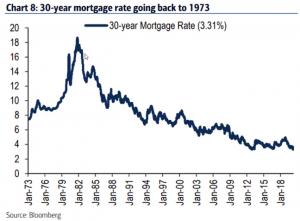

This chart of historic mortgage rates can help tell the story of what’s going on.

These rates are very low right now, but the interesting thing is we aren’t even done. The correlation on mortgage rates should be more like 2% based on current rates from the Fed.

So 3.31% is high compared to how it should be. Why?

- Capacity – lenders are overwhelmed right now and don’t have the capacity to fulfill all of the people requesting mortgages right now

- Liquidity – lenders can’t take on more business. They aren’t even quoting interest rates a lot of the time, or if they do they’ll keep their rates artificially inflated.

- Risk – lenders aren’t excited about potential losses from clients going into forbearance. So they’ll inflate the interest rate to help compensate for the risk

We are advising clients to tell us what kind of interest rate you want to target. Have everything ready to go, so you can hop on it as soon as it’s possible.

There are going to be many people asking for refinancing. Rates will be low, that’s why they’re helping prepare their clients now so they’re able to take advantage of it quickly.

Keep in mind that it’s a good thing if home price increases slow down. Right now the average middle-class person spends around half of their income on the cost of their home. Buying a home should be fun, but right now it feels like a war because it’s so costly.

We’ll see great opportunities come up from this:

- Buyers love price drops

- People have lost their homes, so fewer people are able to buy a home right now

- Increased supply and short term decrease in demand will result in sellers willing to negotiate

How Can We Best Help Out Clients?

- Fully utilize the current and near term financial situation.

- Develop a strategy for navigating any losses or bad decisions

- Get secondary guidance from industry experts – CPA, financial planners, real estate/mortgage professionals, attorneys

- Continual support and guidance on a monthly basis

- Provide relevant and timely content

Can We Help You?

If you have questions, please reach out at Team@RyanGrantTeam.com or give us a call at 949-651-6300. We’d love to help you navigate through this time and take advantage of the opportunity we’re going to see in the next 6-12 months.