“Home prices falling faster now than in 2006.”

This is a popular headline that has hit the news outlets recently, and it is causing even more panic for potential homebuyers.

We all know the media always enjoys any bit of bad news that will get more clicks and views, but more often than not they fail to dig into the data to get the real story.

Yes, home prices have fallen for the first time in a really long time – and it is marking a shift in the real estate market and the overall economy – but it is not the beginning of a catastrophic crash like the media would lead you to believe.

The data that is stoking the fear comes from Black Knight, who reported that July and August 2022 marked the largest single-month price declines seen since January 2009 (1.05% and .98% respectively).

A decline this small is hardly a cause for panic, especially considering that fact that prices have risen 20% in the last year alone. But it does signify a change, which as we’ve discussed before is a correction and not a crash.

There is one big factor that will prevent a steep decline in home prices – inventory.

Why Housing Inventory Will Remain Tight

While spiked mortgage rates have caused a historic pullback in buyer demand in recent months, it hasn’t translated into a massive inventory spike.

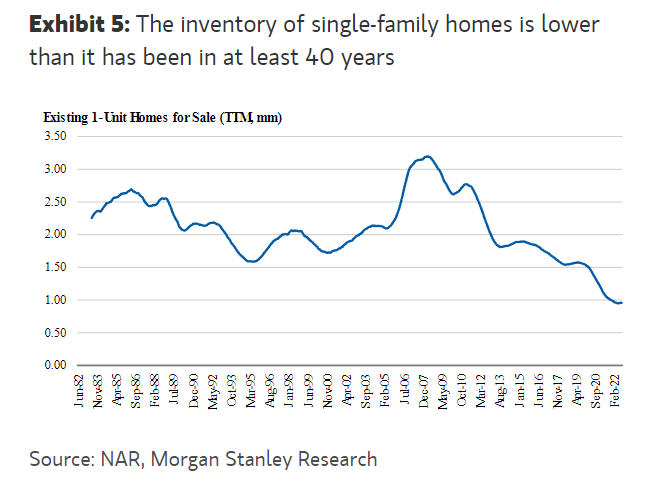

At the beginning of this year, the number of existing single-family homes available for sale was at the lowest it has ever been since it began being tracked in 1982.

Inventory has risen slightly since February, but it is still drastically low. For a meltdown or crash to happen, we would need to see a huge boost in inventory, and that is not going to happen for three major reasons.

1. Current homeowners don’t want to give up their low rates

Homeowners that were lucky enough to secure a low rate in 2020 or early 2021 don’t have much reason to sell in an environment of high rates and slowing home price growth. This is creating a “lock-in” effect and keeping inventory far tigher that it would be otherwise.

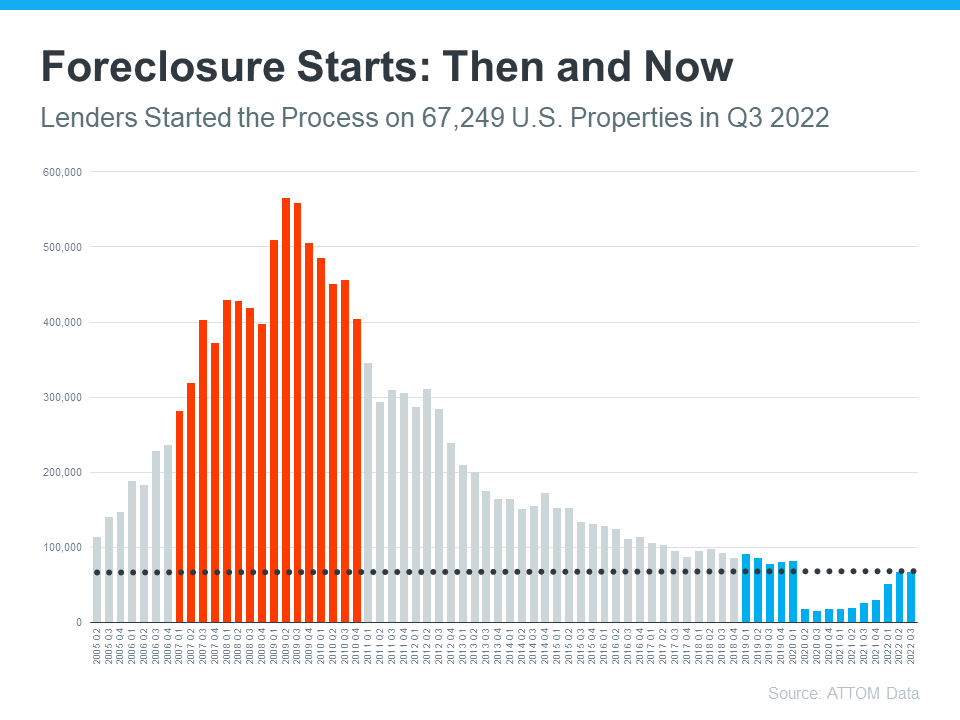

2. Foreclosure activity is limited

Foreclosure activity is much lower since even before the housing crash. This is largely because borrowers today are more qualified and have lower mortgage payments so they are less likely to default on their loans, but it is also thanks to record amounts of home equity.

According to a recent report by CoreLogic, the total average equity per borrower was up to almost $300,000 in Q2 of 2022. Home price growth and the refinance boom of the last two years have helped bring down the national average loan-to-value ratio to 42%, which is the lowest it has been since 2010. This means the average homeowner has 58% equity in their home.

With that much to fall back on, it is very unlikely someone would be forced to sell if they could not afford their mortgage payment.

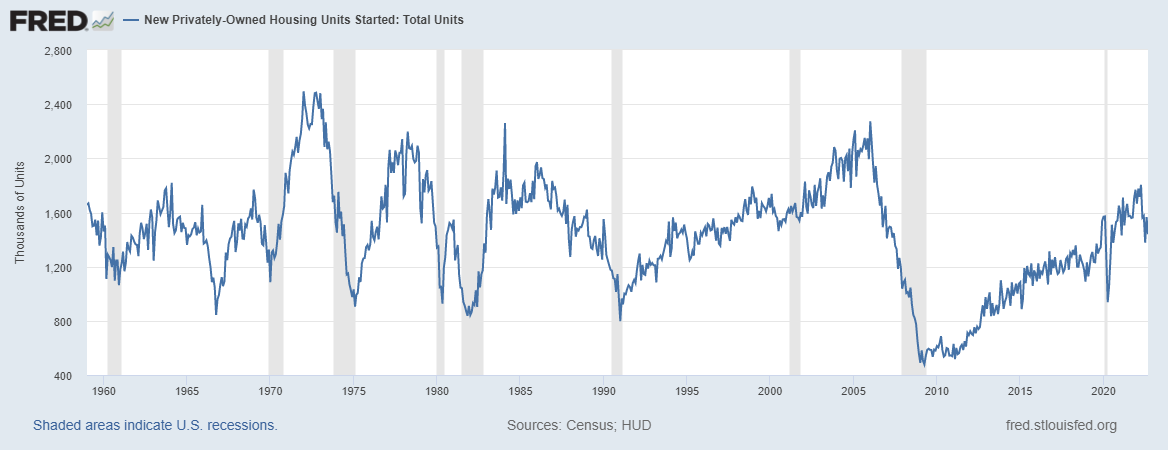

3. Builders have still not been able to catch up

In the years following the housing market crash, high inventory and low prices made builders stop building homes. We still have not recovered from that period.

Not only have builders been bringing new homes to market at a much slower pace than they were prior to 2008, but they have slowed that pace even more in the face of higher interest rates and recession concerns. Housing starts for single-family homes dropped nearly 19% year over year in September, and building permits (which are an indicator of future construction) fell 17%.

The Bottom Line

The housing market is in uncharted territory right now, but we are still only seeing a correction – not a crash.

Yes, high rates are severely affecting affordability. But at the same time, there are few forced sellers and there simply hasn’t been enough homes being built to meet the population demands of this country.

There are so many millennials who are forming households today, and these millennials are in their peak homebuying years. Regardless of what happens with the economy, there simply aren’t enough single family homes to meet the needs of all the people who want to live in them. This demand source will prevent a steep decline in prices while affordability remains tight.