Housing bubble concerns have been rising as fast as today’s home prices. Today’s market is much safer than the one leading up to 2006 though. Here are three reasons why you can be confident our current market will remain strong.

1. SAFER LENDING STANDARDS

Today’s borrowers are much more qualified for the loans they receive. The Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers’ Association is one way to look at this data. The MCAI shows the availability of mortgage money. As the index rises, the easier it is to get a mortgage. In 2006 just about anyone could qualify for a loan when the MCAI was at 869. Today we are at a much tighter 130.

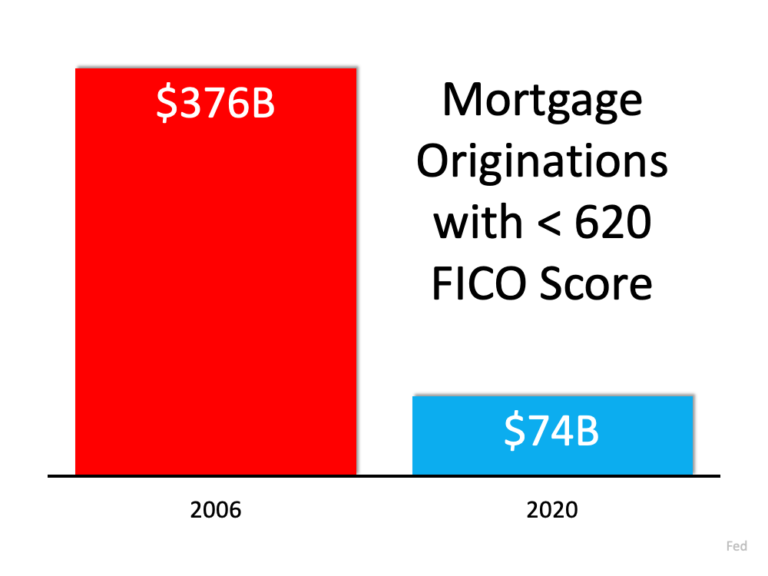

To give you a visual of how much stricter modern lending standards are, let’s compare the volume of mortgages given out to buyers with a credit score less than 620 between today and 2006.

Today’s amount is less than a ¼ of what was given out in 2006. Dr. Frank Nothaft, Chief Economist for CoreLogic, agrees that these standards are helping keep the market safe,

“There are marked differences in today’s run-up in prices compared to 2005, which was a bubble fueled by risky loans and lenient underwriting. Today, loans with high-risk features are absent and mortgage underwriting is prudent.”

2. HOMEOWNERS ARE LETTING THEIR EQUITY BUILD

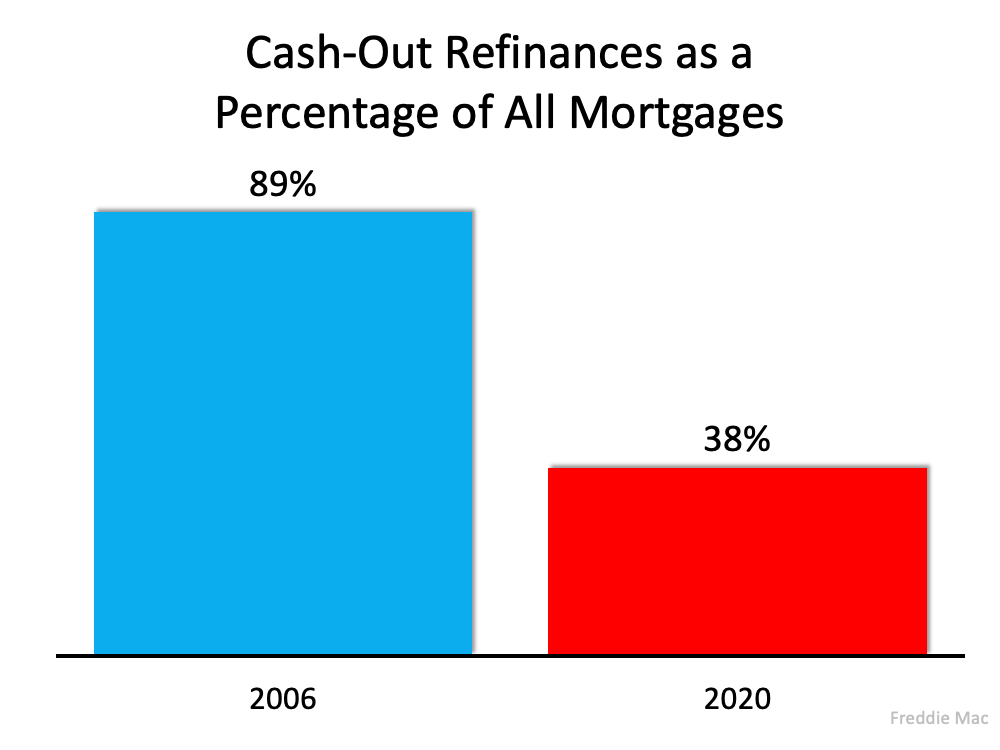

When prices were skyrocketing in the early 2000s, people were using their equity to refinance and quickly acquire some cash. When home prices began to drop, many homeowners found themselves with negative equity. They were paying off a mortgage that was higher than the value of their home.

Most homeowners today are letting their equity build. Research from Freddie Mac shows that the number of cash-out refinances today is less than half of 2006.

3. TODAY’S MARKET IS A SIMPLE CASE OF SUPPLY AND DEMAND

There was an over seven-month supply of inventory on the housing market in 2006. Our current market is sitting at just over two months.

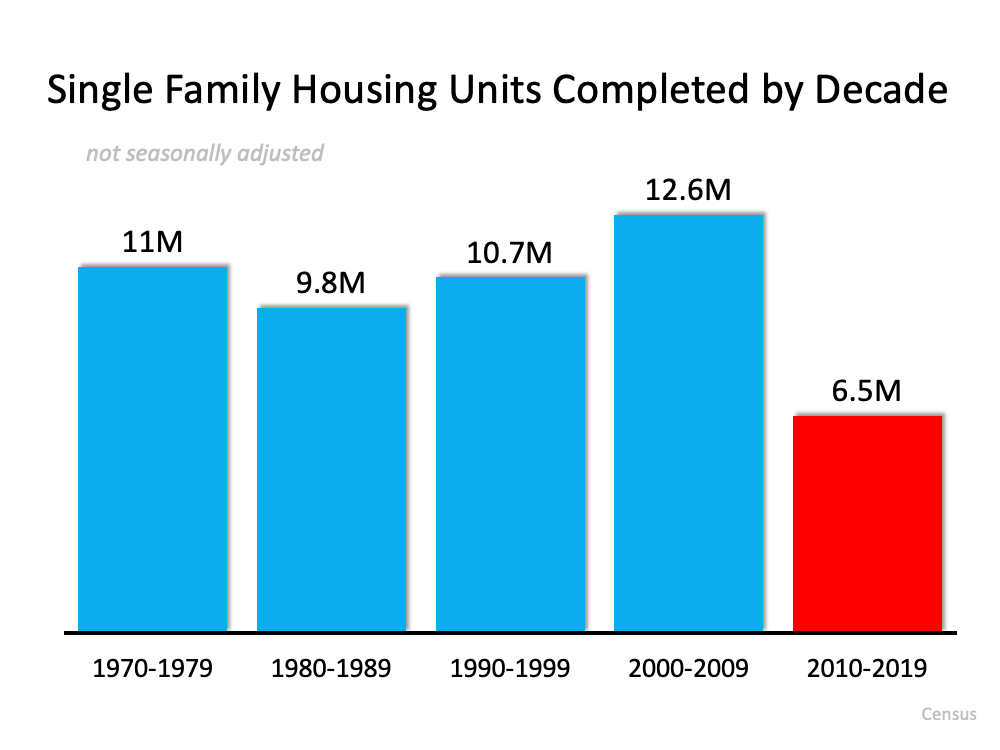

Sam Khater, VP and Chief Economist of Economic and Housing Research at Freddie Mac, explains that lack of building is one of the biggest leading causes of today’s supply problems,

“The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes.”

The chart below shows the steep decline in single-family homes completed this decade compared to last.

There is some good news on the horizon for housing inventory. A recent data report from Realtor.com shows that new listings in June were up 5.5% year-over-year. George Ratie, Realtor.com senior economist, added,

“Inventory declines improved over the steep drops seen earlier in the pandemic as sellers stepped back into the market in a variety of price ranges across the country.”

BOTTOM LINE

Today’s market has better lending standards and more careful borrowers than the one leading up to 2006. Buy your home with confidence knowing that demand will remain strong for years to come. Mark Fleming, chief economist at First American Financial, reiterates this point,

“This year, the largest section of millennials will turn 30, entering their prime homeownership years… millennials may be poised to fuel a ‘roaring 20s’ of homeownership demand.”