Home prices are appreciating fast. Over the past year, they went up a staggering 16%. A number that can be discouraging to many first-time home buyers.

But if we compare today’s prices with historical data, the current housing market has remained more affordable and, if you adjust for inflation, less expensive than most times in the past few decades.

RECORD-LOW INTEREST RATES KEEP HOUSING AFFORDABLE

Housing affordability is the combination of incomes, interest rates, and home prices.

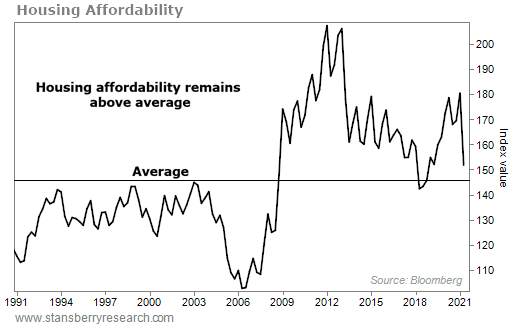

The higher the value on the chart below, the more affordable the typical home is for the average American family.

A value of 100 means that the average American family’s income will be able to afford the typical home price. Today’s value is well above the average of the last 30-years, even with a drop this year.

Our current value of 150 means that the typical family can afford 150% of the average home selling price. Even though prices have risen, they are remaining affordable for most families.

WHEN ADJUSTED FOR INFLATION – TODAY’S HOME PRICES ARE CONSISTENTLY LESS EXPENSIVE

When looking back over the past few decades, home prices have gone up significantly. So too have eggs, milk, and bread. This is called inflation and it reflects the rising costs of goods and services throughout the economy.

If we adjust for inflation we can see what a home purchase today would look like 10, 20, or 45 years ago.

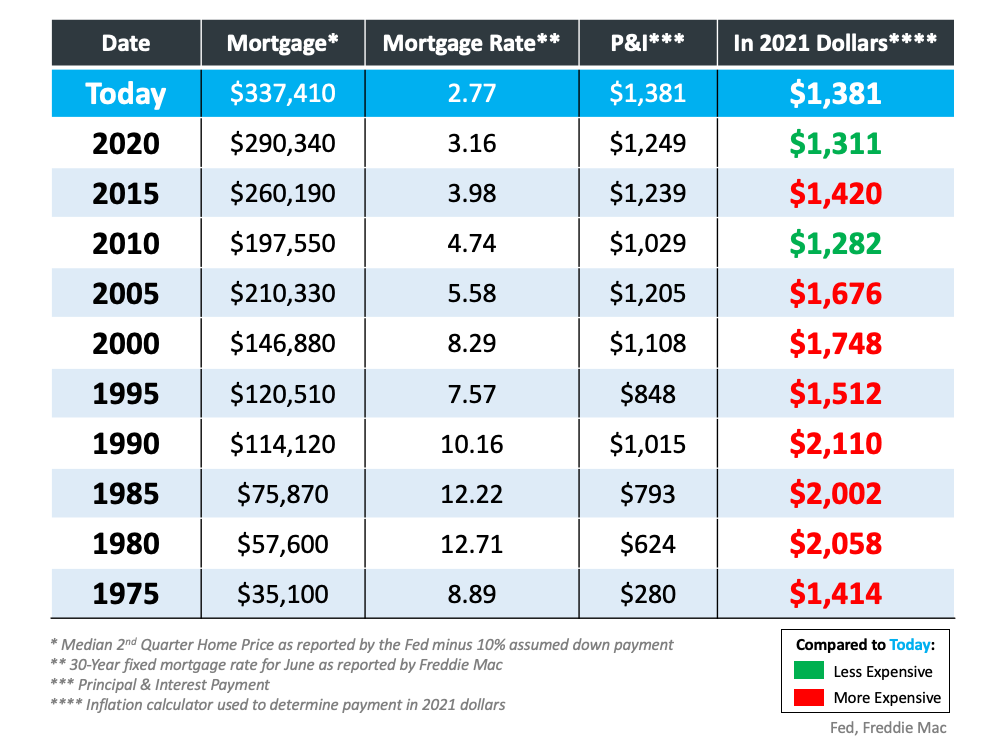

Here’s how each data point has been calculated in the table below:

- Mortgage Amount: The median sales prices with an assumed 10% down payment as reported by the Fed in the second quarter of each year.

- Mortgage Rate: The monthly 30-year fixed rate for June of the given year as reported by Freddie Mac.

- P&I: The monthly principal and interest on the loan as determined by a mortgage calculator.

- In 2021 Dollars: Adjusting the payment amount with an inflation calculator to show what the price would be with today’s dollars.

GREEN = less expensive than 2021. RED = more expensive than 2021.

Over the past 45-years, we’ve only seen home prices more expensive than today TWICE, when adjusted for inflation. Don’t be discouraged by last year’s prices, the current home price is still a better deal than most points in time over the last few decades.

RISING HOME EQUITY OFFSETS THE PURCHASE PRICE OVER TIME

Odeta Kushi, Deputy Chief Economist at First American, explains in a recent article that today’s rising equity also needs to be accounted for in the monthly costs of homeownership,

“For those trying to buy a home, rapid house price appreciation can be intimidating and makes the purchase more expensive. However, once the home is purchased, appreciation helps build equity in the home, and becomes a benefit rather than a cost. When accounting for the appreciation benefit in our rent versus own analysis, it was cheaper to own in every one of the top 50 markets.”

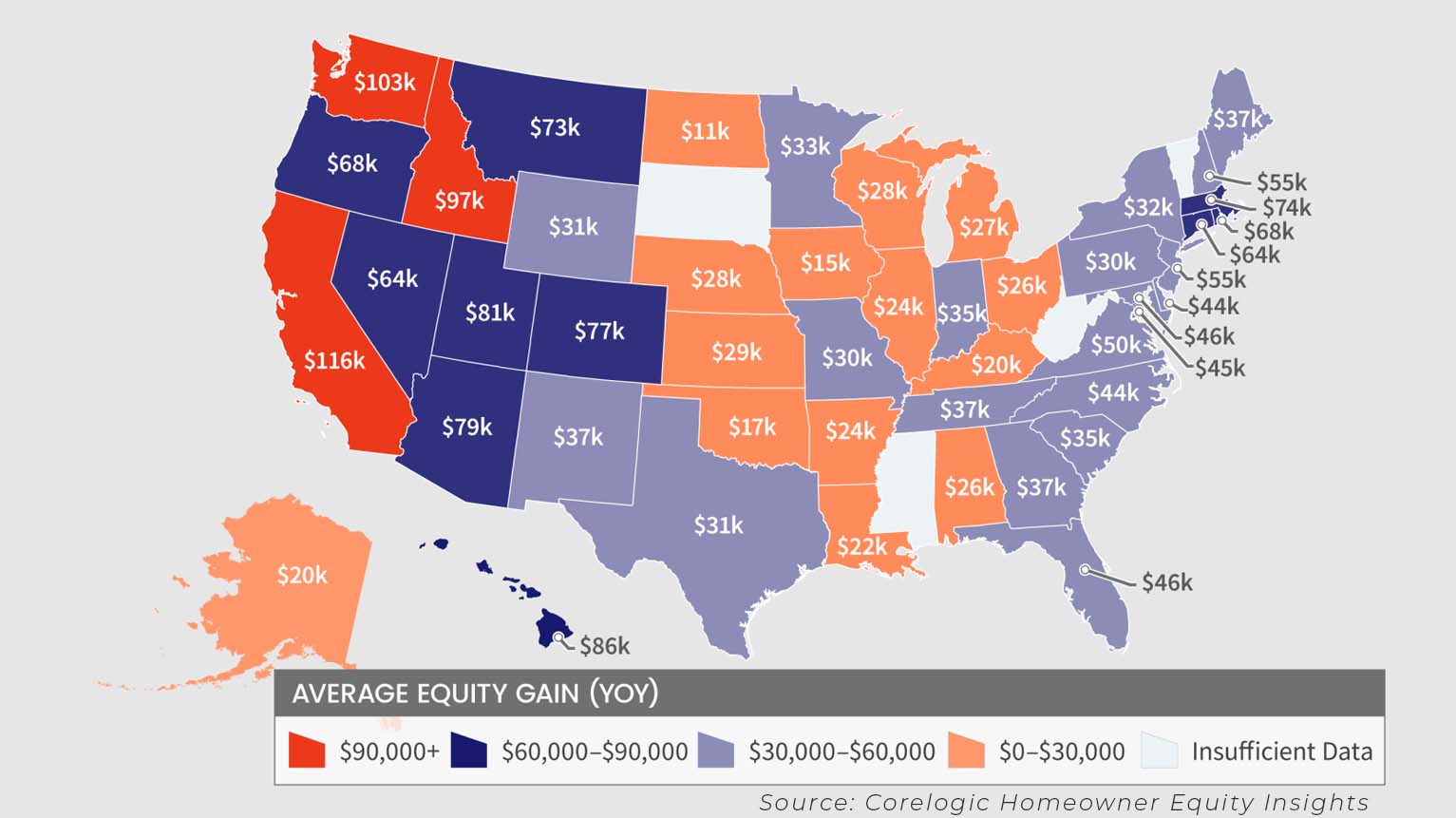

Corelogic’s Homeowner Equity Insights shows the average equity gain for homeowners over the past year was $51,500:

Equity is expected to continue rising too, as we explained in our 2025 Home Price Forecast. When factoring in how much wealth homeowners can generate over time, it’s hard to consider renting a viable option. As Odeti Kushi says, “When your home pays you, it makes more sense to buy than rent.”

BOTTOM LINE

Home prices have become less affordable over the past year, but they are NOT unaffordable. The average homebuyer is getting a better deal today than at almost any other time in the past few decades.

We know today’s housing market is challenging, but don’t give up! We encourage you to look at our Bulletproof Buyer Program. It’s a 4-step program that will put your offer ahead of the competition. Fill out the form below and one of our NEO mortgage advisors can turn YOU into a Bulletproof Buyer!