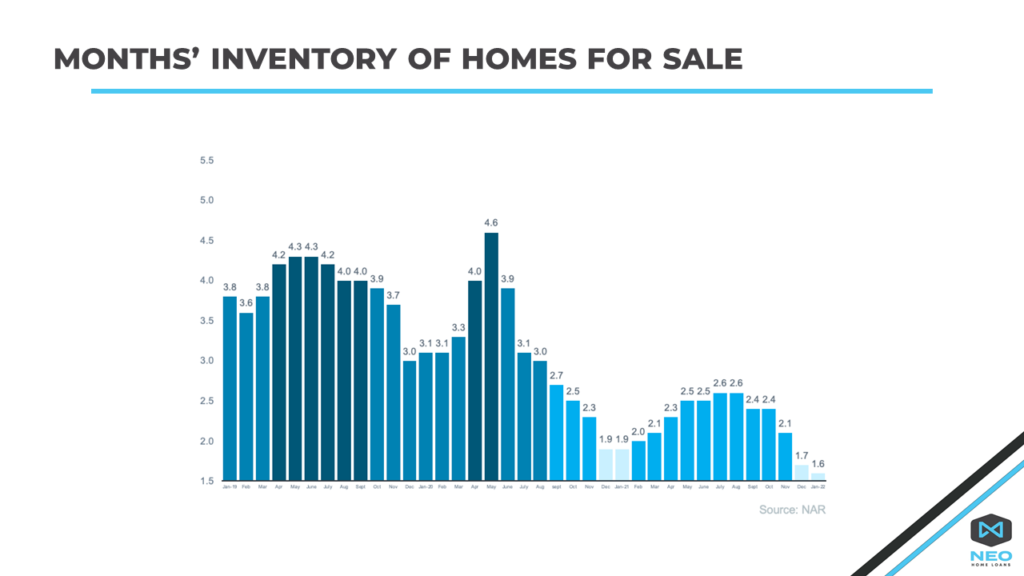

It’s hardly a secret that the residential real estate market has been starved for listings since late 2020. Everyone from first-time homebuyers to seasoned real estate investors are struggling to get their offers accepted. Available home inventory in January of this year was at a 1.6-month supply – another record low.

What does that really mean for you as a buyer in today’s market? Low housing supply coupled with high demand means you should be prepared to navigate a highly competitive market where homes sell fast and get multiple offers.

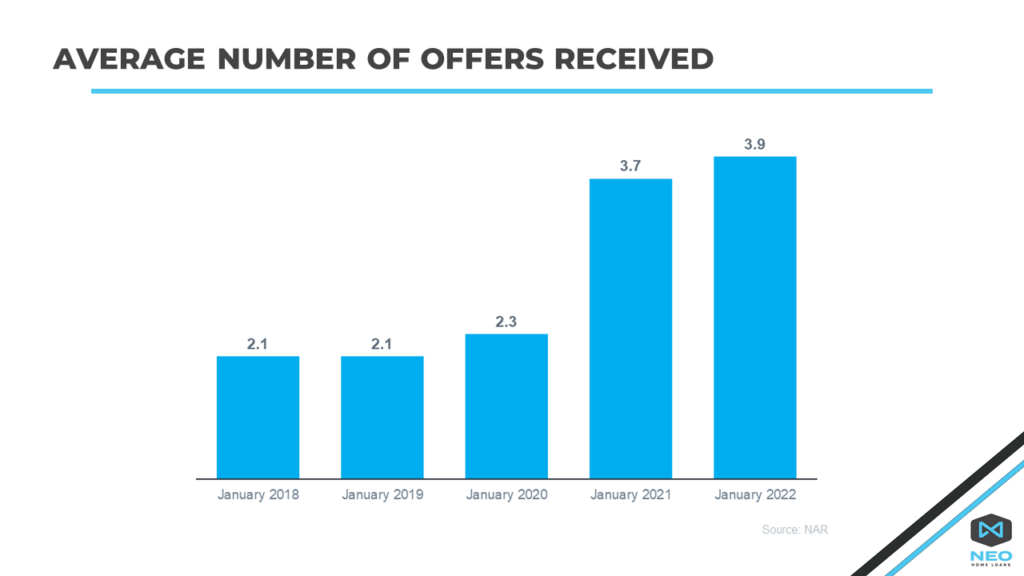

In a bidding war situation like this, doing everything you can to get ahead of the competition is crucial. When you find a house and submit an offer, it will be up against strong offers from other buyers. According to the latest Realtors Confidence Index from the National Association of Realtors (NAR), homes today are receiving an average of 3.9 offers. That’s the most offers we’ve seen in January for the last 5 years.

We understand all of this data might seem intimidating and disheartening, but all is not lost. There are a number of tools you can use to navigate today’s highly competitive real estate market successfully and find a home you love.

1. Know Your Numbers

Knowing your budget and what you can afford is critical to your success as a homebuyer. The best way to understand your numbers is to work with a lender so you can get pre-approved for a loan. Pre-approval shows sellers you’re serious, which can give you a competitive edge.

You should also know making an offer at the home’s asking price may not be enough. Homes today often sell for more than their listing price. A mortgage advisor who understands your financial goals will be able to look at your holistic financial picture to find out how much you will be able to offer.

2. Be Ready To Move Fast

Speed and the pace of sales are contributing factors to today’s competitive housing market. When homes are selling fast, it’s important to stay on top of the market and be ready to move quickly. Not only is a pre-approval essential to making this happen, but you also need a mortgage team that can submit your loan into processing and underwriting right away and get your loan closed in a matter of days.

3. Make a Strong but Fair Offer

When you’re up against other offers, putting your best offer forward from the start is key. Lean on your real estate agent to write a strong offer and use their expertise on which levers you can pull to make your offer as enticing as possible. Choosing a lender that can give you a fully underwritten pre-approval will make you feel comfortable offering a higher amount of earnest money and even waiving the financing contingency, making the offer more attractive.

However, even with the strongest offer possible, sometimes there are offers that are just too good for home sellers to pass up: all-cash offers. These offers are more attractive because they can remove even more contingencies, and skipping the need for a loan means the deal can close almost immediately.

Luckily, there are new ways you can make an all-cash offer even though you need a mortgage. NEO Home Loans has partnered with a real estate services company called Revive. Through their Trade Up program, Revive allows home buyers to leverage the ability to make quick closing cash offers to beat out other buyers and get the best price. Once you are approved for your mortgage, they will buy the home on your behalf in cash in as little as 10 days. Once the transaction is done, you can purchase the home back from Revive with the mortgage loan you qualified for – all you need is a pre-approval from NEO Home Loans.

Conclusion

We know it’s tough out there for home buyers, but there are strategies you can implement that will increase your chances of finding a home and getting your offer accepted.

We would love to be in your corner during your home buying process, whether that’s by quickly approving you for a loan or helping you submit an all-cash offer. If you are ready to start the process or would like to learn more about how we are helping homebuyers win in today’s market, fill out the form below to request a consultation with a NEO Home Loans mortgage advisor.